Table of Contents

Keeping track of bookkeeping can be overwhelming. A QuickBooks survey found that 58% of small business owners struggle to understand their financial data.

Managing invoices, payroll, and tax deadlines takes time that could be spent on running the business.

For many, the solution lies in outsourced bookkeeping services, which handle financial tasks without the hassle of hiring an in-house team.

These services take care of transaction recording, payroll, and financial reporting, allowing businesses to focus on expansion while reducing errors.

The benefits of outsourcing bookkeeping are backed by data. A recent survey conducted by BruntWork found that 82% of businesses that outsourced their bookkeeping reported increased efficiency in financial management.

The study, which included 1,500 business owners and finance professionals, highlights the growing preference for outsourcing as a cost-effective and reliable solution.

With accuracy, cost savings, and time efficiency being top priorities, outsourced bookkeeping is becoming an essential strategy for businesses of all sizes.

This guide will explain how bookkeeping outsourcing services work, their benefits, and how to choose the right solution for your business.

What Are Outsourced Bookkeeping Services?

Handling financial records can be time-consuming, but outsourced bookkeeping services offer an efficient way to manage business finances.

Instead of hiring an in-house team, companies work with external professionals who specialize in maintaining accurate financial records.

This option helps businesses stay organized without the added responsibility of managing a full-time employee.

Small businesses and startups benefit the most from bookkeeping outsourcing services, as they gain access to professional bookkeeping without the high costs of hiring staff.

This service keeps financial data accurate and organized, allowing business owners to focus on their operations.

Key Services Typically Offered

Outsourced bookkeepers manage several essential tasks, including:

- Transaction Recording: Every financial movement is logged, helping businesses track revenue and expenses.

- Payroll Management: Ensuring employees receive payments on time while payroll taxes are properly calculated.

- Financial Reporting: Generating reports such as profit and loss statements and balance sheets for a clear overview of financial performance.

- Bank Reconciliation: Comparing financial records with bank statements to detect errors and maintain accuracy.

Working with outsourced accounting and bookkeeping services prevents bookkeeping errors and helps businesses stay prepared for tax reporting.

Pro Tip: Regularly review your financial reports to ensure the accuracy of your records and prevent discrepancies before they become larger issues.

How Outsourced Bookkeeping Benefits Businesses

Companies of all sizes choose to outsource bookkeeping service providers for several reasons:

- Lower Costs: Hiring a full-time bookkeeper comes with salaries, benefits, and training expenses. Outsourcing is a more affordable option.

- More Time for Business Operations: Instead of spending hours handling financial records, business owners can focus on sales, strategy, and customer service.

- Fewer Mistakes: Accurate financial records prevent compliance issues and reduce financial risks.

- Scalability: As a business grows, bookkeeping needs become more demanding. Outsource bookkeeping solutions adjust to the company’s needs without the hassle of hiring more employees.

Virtual Assistant Bookkeeping: A Flexible Option

Some businesses prefer virtual assistant bookkeeping as a cost-effective way to manage finances.

A virtual assistant can take care of bookkeeping tasks remotely, such as recording transactions, reconciling accounts, and preparing reports.

This option is ideal for startups and small businesses that need bookkeeping support without committing to full-time staff.

Outsourcing bookkeeping simplifies financial management and allows businesses to maintain accurate records without handling everything internally.

Choosing the right service provider ensures businesses receive the support they need to stay financially organized.

Stop Worrying About Bookkeeping. We’ll Handle It!

Focus on your business. We’ll handle the numbers. Get started today!

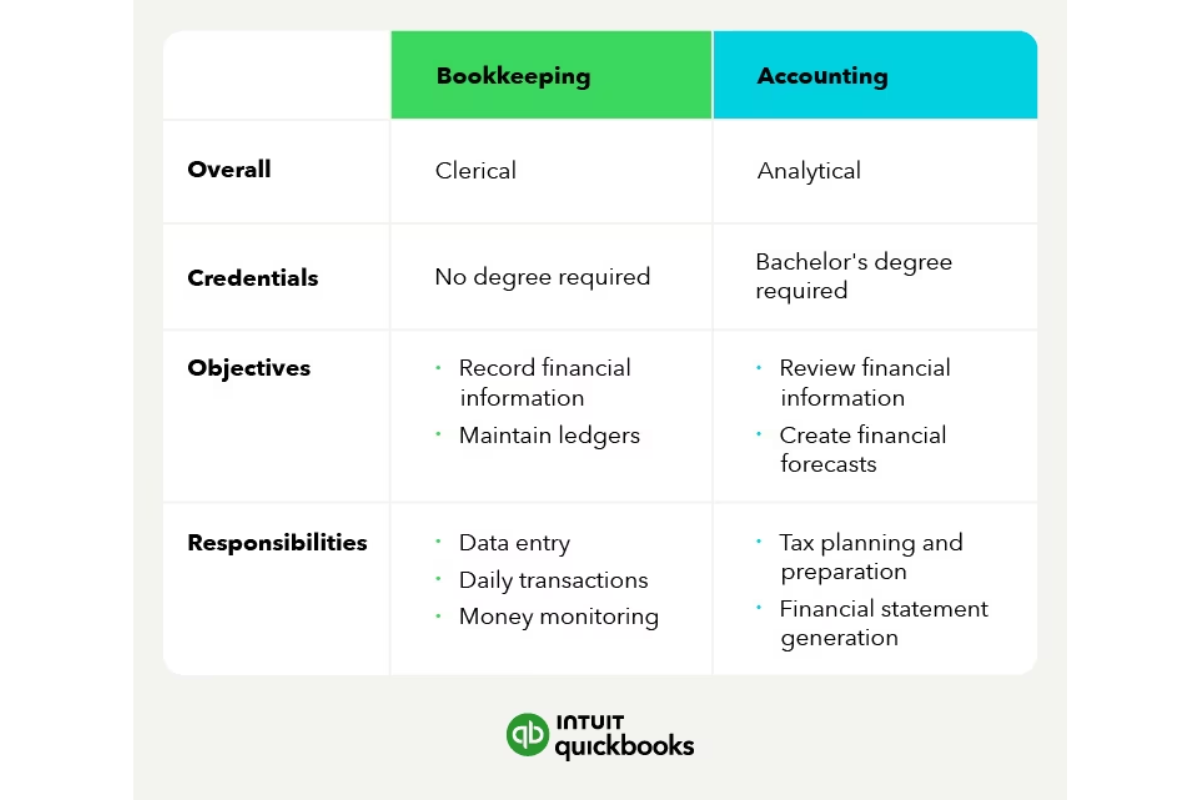

Accounting vs. Bookkeeping Services: Understanding the Key Differences

Understanding the difference between bookkeeping and accounting helps businesses make informed financial decisions.

Whether considering outsourced bookkeeping services or hiring an in-house professional, knowing the distinction ensures the right support for financial management.

What Does a Bookkeeper Do?

Bookkeepers handle the daily financial transactions of a business. Their tasks include:

- Recording sales, expenses, and other financial activities

- Managing invoices, receipts, and payments

- Keeping financial records accurate and up-to-date

A well-maintained bookkeeping system allows businesses to track cash flow and prepare for tax season efficiently.

Pro Tip: Keep regular backups of your financial data and use secure cloud-based systems for added security and easy access to your records.

What Does an Accountant Do?

Accountants focus on interpreting financial data to help businesses understand their financial position. Their responsibilities include:

- Analyzing records to assess business performance

- Preparing financial statements and tax returns

- Offering guidance based on financial trends

Accountants work with bookkeeping data to generate reports that help businesses make strategic decisions.

How Outsourced Bookkeeping Services Differ from Accounting

Source: QuickBooks

Businesses often use outsourced accounting and bookkeeping services to manage finances efficiently. The decision depends on the type of financial support needed.

- Outsourcing bookkeeping works well for businesses that need help tracking daily transactions, managing invoices, and maintaining financial records.

- Outsourcing Accounting is useful when tax planning, financial forecasting, and compliance support are required.

- Using both services provides full financial management, covering both record-keeping and financial strategy.

Pro Tip: If you need both services, look for a provider who can integrate both accounting and bookkeeping functions to streamline your processes.

Choosing the Right Service

Before selecting a bookkeeping outsourcing service, consider the following:

- The type of financial support needed

- Whether daily record-keeping, financial analysis, or both are required

- The benefits of outsourcing versus managing finances in-house

Top 10 Outsourced Bookkeeping Services for 2025

Outsourcing bookkeeping helps businesses save time and money while gaining access to skilled financial management.

Many providers offer these services, so finding the right one depends on factors like business size, budget, and specific bookkeeping needs.

Below is a breakdown of some of the best outsourced bookkeeping services available in 2025.

1. BruntWork

BruntWork leads the market in outsourced accounting and bookkeeping services, offering solutions for businesses of all sizes.

Their team handles general ledger management, accounts receivable and payable, bank reconciliation, financial reporting, and tax preparation.

Each outsourced bookkeeper at BruntWork has at least five years of experience. The company provides accurate and efficient bookkeeping services at competitive rates, typically between $4 and $8 per hour. Strong data security policies and confidentiality agreements make them a trusted provider.

2. QuickBooks Live

QuickBooks Live offers bookkeeping services for businesses using QuickBooks software. Users answer a few questions and connect with a live bookkeeper for real-time support.

This service works well for startups and small businesses looking for bookkeeping that integrates directly into their existing accounting system.

3. Bench

Bench, based in Canada, specializes in outsourced bookkeeping services for small businesses.

Their team offers tax advisory, monthly financial reporting, and bookkeeping through proprietary software.

While Bench provides a user-friendly platform, businesses using other accounting systems may face software compatibility issues.

4. Paro

Paro connects businesses with highly experienced financial professionals. Their platform pairs companies with top-tier bookkeepers and accountants.

Paro accepts only the top 2% of applicants, all with at least 15 years of experience, making them a premium option for businesses that need financial expertise.

5. Merritt Bookkeeping

Merritt Bookkeeping focuses on essential bookkeeping tasks at a flat rate. Their services include transaction recording, account reconciliation, and financial reporting.

The affordable pricing structure makes this an option for businesses that need basic bookkeeping but not advanced financial management.

6. Pilot

Pilot specializes in working with startups. Their team provides bookkeeping, financial statement preparation, and CFO-level guidance. The service also supports integrations with platforms like Gusto, Expensify, and Stripe.

7. Bookkeeper360

Bookkeeper360 provides bookkeeping, payroll, and financial reporting services. Their platform works with multiple accounting software options, making it a good choice for businesses that want flexibility.

8. Bookkeeper.com

Bookkeeper.com has been in business for over 25 years. Their services cover bookkeeping, accounting, payroll, and financial consulting, all delivered online. Pricing includes both fixed and custom options, allowing businesses to select the best fit.

9. Upwork

Upwork allows businesses to find freelance bookkeepers for short-term or project-based work.

Employers can search for bookkeepers based on specific needs and budgets. However, finding the right freelancer requires time and effort, as screening candidates is necessary.

10. Near

Near helps businesses find experienced bookkeepers in Latin America. Instead of providing bookkeeping services directly, Near simplifies the hiring process, allowing companies to interview and hire pre-vetted professionals in under 21 days.

Their network includes over 35,000 candidates, ensuring businesses can find skilled bookkeepers at budget-friendly rates.

Choosing the Right Outsourced Bookkeeping Provider

Several factors help determine the best outsourced bookkeeping services for a business:

- Industry Experience: Some bookkeeping providers specialize in certain industries, making them better suited for specific financial needs.

- Service Offerings: Providers differ in their range of services, from basic bookkeeping to full accounting solutions.

- Reputation: Customer reviews and testimonials provide insight into service quality.

- Technology Integration: Ensuring a provider’s software works with existing systems can prevent workflow disruptions.

- Communication & Accessibility: Some providers offer dedicated account managers or 24/7 support.

- Pricing & Scalability: Comparing pricing structures helps businesses find an option that fits their budget and growth plans.

A well-chosen outsourced bookkeeper helps businesses manage their finances more effectively.

Evaluating these factors will make it easier to select a bookkeeping provider that aligns with business goals.

Advantages of Outsourcing Bookkeeping

Keeping track of business finances requires staying up to date with changing regulations. According to the Global Business Complexity Index 2024 by TMF Group, compliance laws are tightening worldwide.

Many businesses are turning to outsourced bookkeeping services to manage financial tasks efficiently while avoiding the risks of falling behind on legal requirements.

Cost Savings Without Sacrificing Quality

Hiring a full-time bookkeeper costs between $40,000 and $70,000 per year, excluding benefits, office space, and training.

Outsourced bookkeeping solutions provide the same financial support without the overhead costs of an in-house employee.

Businesses that use virtual assistants for bookkeeping save even more since these professionals handle multiple administrative tasks.

The benefits of hiring a virtual assistant include cost-effective bookkeeping, invoice management, and payroll support—all in one service.

Skilled Bookkeeping Without Additional Training

Instead of investing in training for an in-house team, businesses gain access to professionals with industry knowledge.

Outsourced accounting and bookkeeping services use software like QuickBooks, Xero, and FreshBooks to keep financial records accurate and compliant with tax laws. This approach saves time while reducing the risk of accounting errors.

More Time to Focus on Growth

Managing bookkeeping in-house can take valuable time away from strategic tasks like customer relations and business development.

Outsourcing allows business owners to focus on increasing revenue while handling financial records with trained professionals.

Tasks like account reconciliation, expense tracking, and financial reporting become stress-free when managed by a bookkeeping outsourcing service.

Scalable Services That Adapt to Business Needs

Outsourced bookkeeping services adjust to meet business demands. Companies can increase financial support during tax season or reduce services during slower months.

This flexibility helps businesses manage costs effectively while still receiving the bookkeeping assistance they need.

Streamlining Bookkeeping With Virtual Assistants

Combining outsourced bookkeeping with virtual assistant services allows businesses to handle financial tasks alongside scheduling, customer inquiries, and other administrative responsibilities.

A virtual assistant can support bookkeeping tasks while ensuring daily operations run smoothly, making financial management more efficient.

Outsourcing bookkeeping simplifies financial management, saves time, and reduces costs. Whether through a bookkeeping firm or a virtual assistant, businesses that rely on external support gain financial accuracy without the hassle of hiring in-house staff.

Ditch the Bookkeeping Hassle

Focus on your business while we handle the numbers. Get a consultation today!

Potential Disadvantages of Outsourcing Bookkeeping

Outsourced bookkeeping services help businesses save time and money, but they also come with certain downsides.

Business owners need to consider control, communication, and security risks before handing over their financial records. Addressing these concerns properly will make outsourcing more effective.

Limited Control Over Financial Processes

Managing bookkeeping in-house allows direct oversight of financial activities. Transactions can be reviewed instantly, and decisions can be made on the spot.

Outsourcing shifts some of that control to an external provider, which may cause delays in approvals or visibility gaps.

To stay informed and maintain oversight:

- Request Regular Financial Reports: Weekly or monthly updates help track financial activity.

- Define Approval Workflows: Set guidelines on which financial decisions require business owner authorization.

- Establish Performance Benchmarks: Hold providers accountable for accuracy and response times.

Communication Barriers with Remote Bookkeeping

Working with an outsourced bookkeeping service means dealing with providers in different time zones. Delays in response times or unclear communication may slow down financial processes.

Ways to improve coordination:

- Use Cloud-Based Accounting Software: Platforms like QuickBooks and Xero provide real-time access to financial data.

- Set Clear Expectations for Communication: Define preferred contact methods and expected response times.

- Hold Routine Check-Ins: Weekly or bi-weekly meetings help maintain alignment.

Risks Related to Data Security and Privacy

Outsourcing means financial data is stored and managed externally. This raises concerns about data breaches, unauthorized access, or compliance with financial regulations.

To reduce risks:

- Choose Providers with Strong Security Measures: Look for encryption, secure logins, and limited data access.

- Use Non-Disclosure Agreements (NDAs): Protect sensitive business information with legally binding agreements.

- Monitor Data Access Regularly: Keep track of who has permission to view financial records.

The Pros and Cons of Hiring Virtual Assistants for Bookkeeping

Some businesses prefer hiring virtual assistants for bookkeeping instead of full-service providers.

While this approach can be cost-effective, it may not be suitable for businesses with complex accounting needs.

Advantages:

✅ Lower costs compared to hiring an in-house bookkeeper.

✅ Flexibility to increase or reduce services based on workload.

✅ Can handle multiple financial tasks beyond bookkeeping.

Disadvantages:

❌ Some virtual assistants lack specialized accounting knowledge.

❌ Limited experience with tax laws and compliance requirements.

❌ Less direct supervision increases the risk of bookkeeping errors.

Understanding the pros and cons of hiring virtual assistants helps businesses decide whether they need a full-service outsourced bookkeeping solution or if a VA can manage their financial records.

How to Choose the Right Bookkeeping Outsourcing Service

Finding the right outsourced bookkeeping services requires careful planning. With many options available, businesses need to focus on what matters most: accuracy, reliability, and efficiency.

A well-matched provider will handle financial records effectively, allowing business owners to concentrate on growth.

1. Define Your Bookkeeping Needs

Before selecting bookkeeping outsourcing services, consider what your business requires. Some companies need basic transaction tracking and payroll processing, while others require detailed financial reports and tax preparation.

- Small businesses often benefit from providers who handle daily expense tracking and invoicing.

- Growing companies may prefer outsourced accounting and bookkeeping services that include compliance and tax support.

- Larger enterprises may need to outsource bookkeeping solutions that integrate with multiple financial systems.

Identifying specific needs helps businesses avoid unnecessary costs and ensures they receive the right level of support.

2. Review the Provider’s Technology and Skills

An experienced outsource bookkeeping service should use modern cloud-based accounting software and follow best practices for data protection.

Strong security measures and system integration make financial management smoother.

Key factors to consider:

- Industry experience (e.g., e-commerce bookkeeping differs from real estate financial tracking).

- Automation tools that reduce errors and improve efficiency.

- Regulatory compliance to avoid legal and tax issues.

- Data security policies to prevent breaches.

Selecting a provider with the right technology and financial skills improves accuracy and organization.

3. Check Reviews and Client Feedback

Not all bookkeeping providers offer the same level of service. Before committing to a provider, research client reviews, ratings, and case studies.

What to look for:

- Customer satisfaction ratings from platforms like Google Reviews and Trustpilot.

- Case studies that show real-world success.

- References from similar businesses to confirm reliability.

A provider with strong feedback and a proven record offers more confidence in long-term service quality.

4. Compare Pricing and Growth Potential

Cost matters, but the cheapest option is not always the best. Look beyond pricing and focus on value for money.

Consider:

- Pricing structure (fixed rates or per-transaction fees).

- Additional costs for services like tax filings and reporting.

- Scalability to match business growth.

A flexible outsourced bookkeeping service should provide custom pricing options that support expansion without sudden cost increases.

5. Choose a Service That Fits Your Business Culture

Bookkeeping providers should align with a company’s way of working. Communication style, responsiveness, and adaptability influence how well they integrate into daily operations.

This connects with the idea of outsourcing non-core functions—businesses can shift bookkeeping to external professionals while focusing on priorities like sales and operations.

What to consider:

- Industry knowledge to handle specific financial needs.

- A communication style that fits the business.

- A working relationship that feels like an extension of the team.

Streamlining Your Finances with the Right Partner

Outsourced bookkeeping services make financial management easier, giving businesses more time to focus on growth.

When considering the cost to hire a virtual assistant, outsourcing bookkeeping provides an affordable way to handle payroll, track expenses, and generate financial reports.

This option helps maintain accuracy while reducing costs, and businesses can adjust services as they expand without the commitment of hiring full-time staff.

Selecting the right provider is important. A bookkeeping service should offer reliable financial support, strong security, and seamless integration with existing accounting tools.

Careful selection reduces errors, improves compliance, and provides valuable insights for decision-making.

Technology continues to shape bookkeeping, automating routine tasks while businesses still need professionals to oversee financial records.

Outsourcing keeps businesses financially organized without getting overwhelmed by numbers. For a flexible and cost-effective solution, hire a virtual assistant to manage bookkeeping today.